Foreclosures in New York City near 2,000. Are banks keeping up the buildings?

NEW YORK – City officials could have acted to prevent the fire deaths of a boy and his parents in an illegally subdivided home that fell into disrepair in the foreclosure crisis, state Sen. Jeffrey Klein said Monday, while the mayor's office disputed the claim.

Mayor Michael Bloomberg and other city officials have said that inspectors who were warned of the dangerous conditions at the Bronx property were stymied by laws preventing them from entering without permission. Fire marshals determined that a candle started the fast-moving blaze in April.

The troubled three-story Bronx building was in foreclosure, and the utility Consolidated Edison had shut off the electricity because it had no record of tenants at that address. But the victims and others were living there in illegally subdivided apartments where access to fire escapes was blocked, city officials said.

Klein said at a press conference held at the still-boarded-up home that a 2009 state law would have allowed officials to enter the building after giving seven days' notice to the foreclosing bank — one of a number of lenders that Klein says have been neglecting their responsibilities under the law to begin maintaining the properties as soon as a judgment of foreclosure is declared.

A mayoral spokeswoman, Julie Wood, said that city lawyers believe the state law doesn't go so far as to allow them to forcibly enter a person's home. The mayor has said that constitutional law sets the bar very high for such entry. Klein, meanwhile, called on the city to use the law to begin forcing inspections at the bank-owned properties with outstanding violations.

RELATED: Foreclosures on the rise: Is your city on the Top 10 list?

A spokesman for the trustee for the Bronx property, Bank of New York Mellon, said it had only "a very limited ministerial role" in the matter and wasn't the property's servicer, which would be responsible for collecting rents and performing repairs.

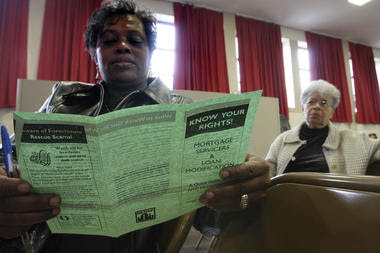

The nearly 2,000 bank-owned foreclosed properties in the city have more than 3,750 unresolved structural violations, according to a survey performed by Klein's office using the online marketplace of foreclosureproperties RealtyTrac.com and released Monday. The senator called it an indication that banks aren't stepping up to perform the repairs mandated by the state law passed in the wake of the housing collapse.

Housing advocates say still more homes are declining as the banks try to delay the foreclosure judgments that would make them responsible for the properties.

The survey found that Deutsche Bank owns more city properties and is responsible for more structural violations than any other bank — with 211 unresolved violations at 285 properties.

Deutsche Bank spokesman John Gallagher said the bank is a trustee and therefore isn't responsible for maintenance of the properties or payment of fines for purported code violations.

"However, the bank takes such issues seriously and takes the appropriate action when notified of alleged violations, including contacting the loan servicer responsible for the property or properties in question," he said in a statement.

U.S. Bank comes in second with 163 violations, followed by Fannie Mae, with 141 violations.

U.S. Bank spokesman Tom Joyce said that while he had not seen Klein's list, he believed the bank was the trustee on the properties, holding a mainly administrative role, and so was not responsible for repairs. That role, he said, falls to the bank that is a property's servicer.

In any case in which U.S. Bank is the servicer of a property, it's "in our interest to make sure that the property is maintained" so it can later be sold, he said.

Comments

Post a Comment